After seven-eight years of acute oversupply, the world aluminium market is now undergoing a structural change from surplus to deficit. An extended period of overcapacity has been a feature of the world aluminium market for some time now.

No doubt, producers in the western world have cut back output but their efforts have been largely neutralised by new capacity additions in China and West Asia. The result has been sustained downward pressure on aluminium prices.

No wonder, LME prices have continued to remain in a narrow range of $1,700-1,900 a tonne.

With long waiting time or queue at LME warehouses, producers were compensated, albeit partially, by the rise in aluminium premiums; but that too is beginning to decline with the LME proposing new rules of warehousing and delivery scheduled to take effect from April 1, 2014.

With production trailing consumption, stocks are beginning to be drawn down, and market balances are tightening.

There is a swing in ex-China balance to deficit this year (estimated at 1.3 million tonnes). Yet, excess capacity in China continues to weigh on the market.

The world aluminium market is struggling to come to terms with, on the one hand, a structural shift from surplus to deficit exceeding one million tonnes expected this year and the next; and on the other, freeing up of up to 1.4 million tonnes of the metal over the next two years following changes to LME warehouse rules.

Even as the Chinese continue to combat overcapacity, the key question is whether the western world will cut output any further without which output growth may increase.

According to industry experts, planned aluminium production cuts have soared since the announcement of the new LME warehousing policy which will eventually reduce smelter profits via lower physical premiums.

Production cuts ex-China have totalled close to 2.4 million tonnes a year of capacity since the beginning of 2012, leading to a sharp change in the market balance from surplus to deficit.

From the demand side, global demand growth is expected to be strong in the next two years (4-5 per cent) thanks to continued growth in BRIC countries and a rebound in G3 demand.

Leading indicators and improvement in global manufacturing confidence support the expectation.

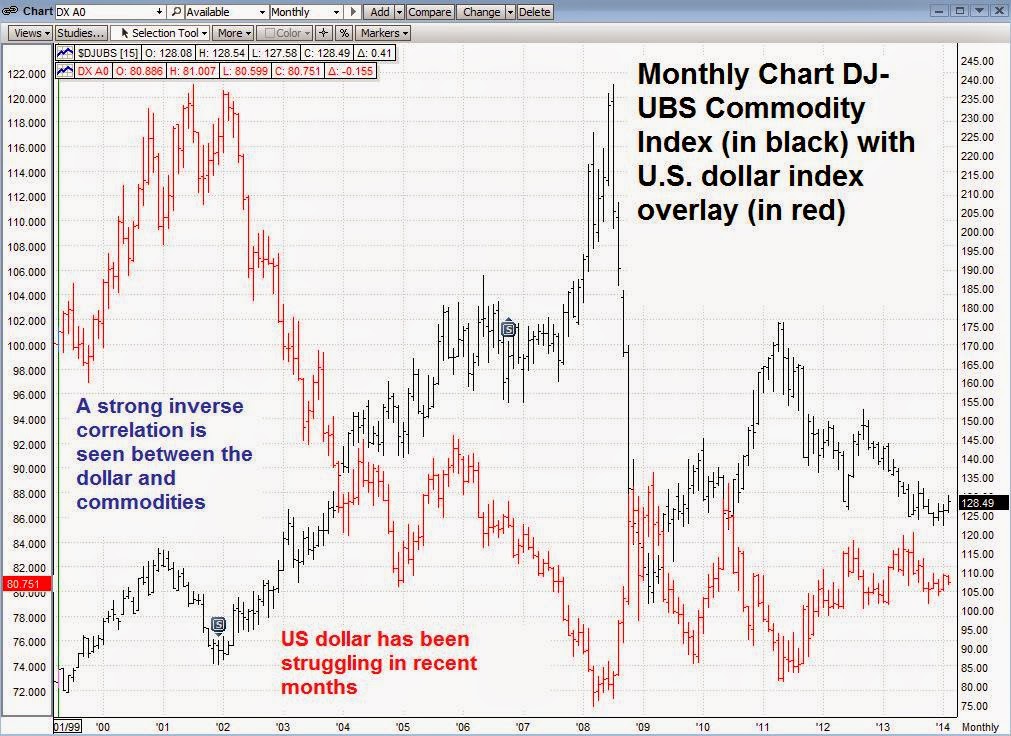

The US is expected to see demand growth of about 3 per cent per annum, while Europe could be something of a wild card because with fiscal austerity less of an issue now, it is possible that European demand may bounce if households and corporates begin to replace durable goods, such as vehicles, and plant and machinery. The US Fed tapering and anticipated dollar firmness is likely to pressure metal prices.

Yet, for aluminium, from here on, if there is a directional change in prices, it is to the upside.

From the recent levels of around $1,660/tonne, aluminium prices have the potential to rise about 5 per cent in H1 and another 5 per cent in H2 this year.

For 2014, the average price of LME aluminium is projected at $1,800 per tonne and for 2015 at $2,100/tonne. Buying on price dips is recommended.

For these prices to sustain, of course, steady flow of positive macro-economic data would help. From an Indian perspective, demand for aluminium has the potential to grow 10 per cent per annum over the coming years even as the country is likely to remain a net importer for two-three years more.

With higher domestic supplies of raw materials, there is scope for stronger Indian demand.At the same time, a weakening rupee will benefit exporters of raw material alumina.