The most common method in which the Fibonacci numbers are used in trading stocks is through Fibonacci retracement. The retracement levels are based on these ratios; 0.236, 0.382 and 0.618.

There are many in the trading fraternity who swear by the Fibonacci numbers.

Those who have not yet been exposed to this wonder-world can benefit greatly by a smattering of understanding of these numbers, for the stock prices seem to have a great affinity to them.

Leonardo Fibonacci, the Italian mathematician popularised the number sequence called the Fibonacci series through his book Liber Abaci published in the 13{+t}{+h} century.

In this book he used the example of sequence in which rabbits multiply to arrive at the series: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144……

Each successive number in this series is the sum of two preceding numbers.

If we divide one number in the series by the number to the right of it, we get the ratio 0.618.

If a number is divided by the number to its left, we get 1.618. A lot has been written about the significance of the golden ratio (1.618) and its recurrence in nature; in the spiral of galaxies, sea shells, sub-divisions of the human body and so on.

Nature seems to have a preference for the numbers in the Fibonacci series and they are seen in patterns in sunflower seeds, pine cones, petals in flowers, branches in a tree and so on.

It should therefore not surprise a market observer that these numbers are useful in forecasting turning points in stock market as well.

Why is that so? As explained before, human emotions are what drive stock markets. Since humans are part of nature, it follows that stock price movements too follow laws of nature.

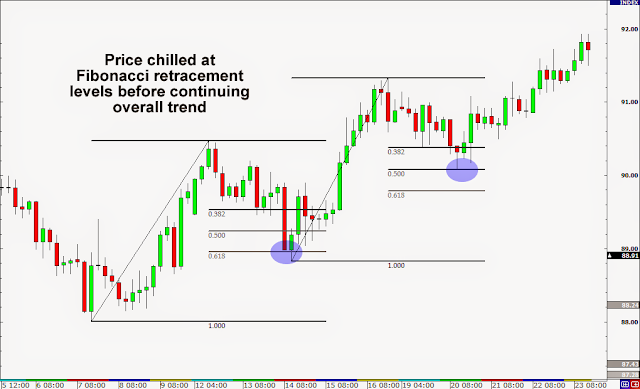

The most common method in which the Fibonacci numbers are used in trading stocks is through Fibonacci retracement. In the Fibonacci number series, if we divide a number by another number, two places away, we get the ratio 0.382 and by dividing by the number that is three places away, we derive the ratio 0.236. The farther we move up the series, the closer the relationship gets to these ratios.

The Fibonacci retracement levels are based on these ratios; 0.236, 0.382 and 0.618. 0.55 is added in between, perhaps because 55 is a Fibonacci number and the half-way mark is always a significant support or resistance.

Once a security completes one leg of a move upward, the retracement supports for the correction that follows is calculated by deducting the product of the magnitude of the up-move and the various Fibonacci ratios and deducting these numbers from the most recent peak.

In a down-move the product of the ratios and the distance travelled is added to the most recent trough to arrive at the levels where the security is likely to face resistance.

These retracement levels are equally effective along all time-frames: intra-day, daily, weekly, monthly or quarterly. The frequency with which stocks take support or reverse lower from the Fibonacci retracement levels is truly awe-inspiring and can convert most traders to ardent followers.