On Wednesday copper futures staged a comeback from six year lows hit earlier in the week as supply disruptions from top producing countries Chile and Peru lift sentiment in beaten down sector.

On the Comex market in New York copper for delivery in December surged as much as 4.7% to a session high of $2.3575 or $5,200 a tonne. Today's advance lifted the red metal out of bear territory for 2015, but at a more than 17% drop since December 31 following a 16% retreat in 2014, no-one's celebrating a bottom yet.

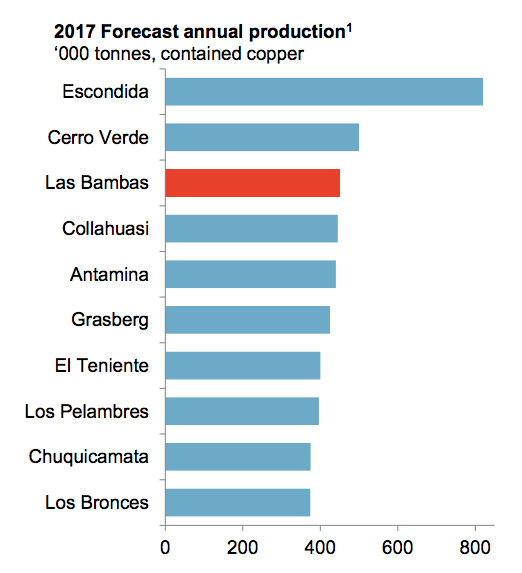

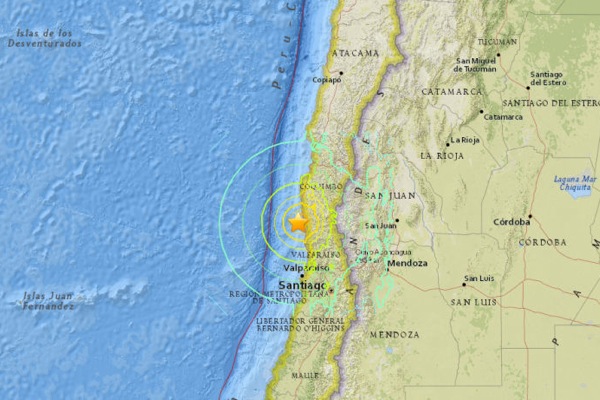

Today's big jump in heavy volume came after news from top producing country Chile. Output at one of the world's largest copper mines, Collahuasi, will be cut by 30,000 tonnes due to current market conditions.

The mine, owned by Anglo American and Glencore produced 470,000 tonnes of copper in 2014, roughly 2% of global output. Earlier this month Glencore announced it's idling mines in Zambia and the DRC that would remove more than 400,000 from the market.

Also on Tuesday Peru declared a state of emergency in the area around the Las Bambas mine after clashes between police and protesters left four people dead and 16 seriously injured.

Minmetals acquired Las Bambas from Glencore in April last year in a controversial $6 billion deal tied to the Swiss giant's merger with Xstrata

Las Bambas is majority owned by China's Minmetals and the 400,000 tonnes per year mine is set enter production in January next year. Minmetals acquired Las Bambas from Glencore in April last year in a controversial $6 billion deal tied to the Swiss giant's merger with Xstrata.

New mines in Peru coming on stream this year and 2016 would double production to 2.8 million tonnes, placing the Peru in second place globally behind Chile.

Copper's move higher gave a bit of a lift to beaten down copper stocks with Glencore's (LON:GLEN) jumping 14% as it continues to recover from a more than 30% fall in London in Monday. Anglo American (LON:AAL) shares also also traded up in New York but year to date declines at the diversified miner remain more than 50%.

Freeport-McMoRan (NYSE:FCX), which vies with Chile's state-owned Codelco as the world number one copper miner in terms of output, was trading 5% higher in early-afternoon dealings but investors in the the Phoenix Arizona based company are nursing a 59% decline since the start of the year. Freeport announced a month ago it is cutting in half output at is El Abra mine in Chile and idling two US mines.

The copper industry has a long history of these supply-side surprises.

Typical disruptions associated with adverse weather (Freeport has predicted lower output at the massive Grasberg mine in Indonesia related to El Niño weather patterns), technical problems, power shortages and labour activity coupled with falling grades and dirty concentrates at old mines (especially true in Chile) make forecasting a tough proposition.

The copper industry has a long history of these supply-side surprises

Add to those factors project deferrals, commissioning delays, slower ramp-ups, mothballing and downsizing of mine plans due to the declining price environment of the last two-three years and it becomes easier to understand why forecasts are all over the place.

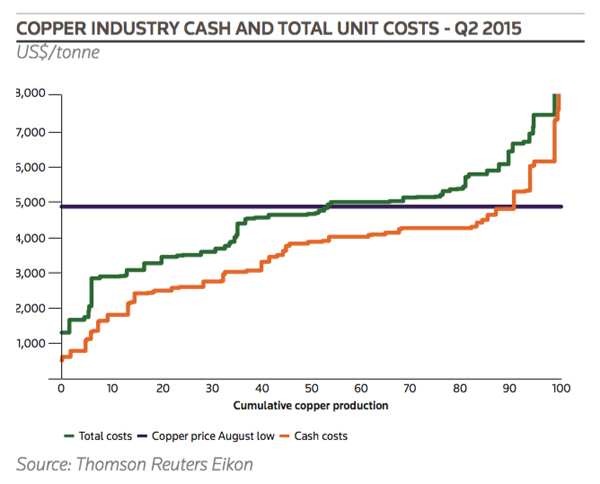

Last week Goldman Sachs predicted the slump in the copper price could last years due to the slowdown in China and that prices will probably drop to $4,800 a metric ton by the end of December and $4,500 at the end of next year as the market suffers from oversupply of 530,000 tonnes next year 2016 rising through 2019 to reach 657,000 tonnes oversupply.

On the opposing side independent research house Capital Economics forecasts a strong pickup in the price of copper towards the end the year on the back of lower than expected mine supply growth and output disruptions.

Senior commodities economist Caroline Bain says Chile’s recent earthquake highlights these risk. Although output was only interrupted briefly, the earthquake and tsunami that struck the South American nation halted operations at the Los Pelambres and Andina mines, which together produce 600,000 tonnes of copper.

Apart from the effects of El Niño (low rainfall is behind the Grasberg output reduction, but on the other side of the ocean the occurrence causes flooding), ongoing strikes and protests, Bain also points to relatively low warehouse inventories which in the case of LME stocks represent only 2–3 weeks of annual consumption for the bullish case.

The house view at Capital Economics is for the price of copper to reach US$6,250 per tonne by end-year, rising to $7,000 by end-2016.