New study shows Greek bond yields as proxy for euro-zone break-up risk is more reliable than the strength of the US dollar in predicting the gold price

The real possibility of a Grexit is back on the cards. And with it a resurgent gold price.

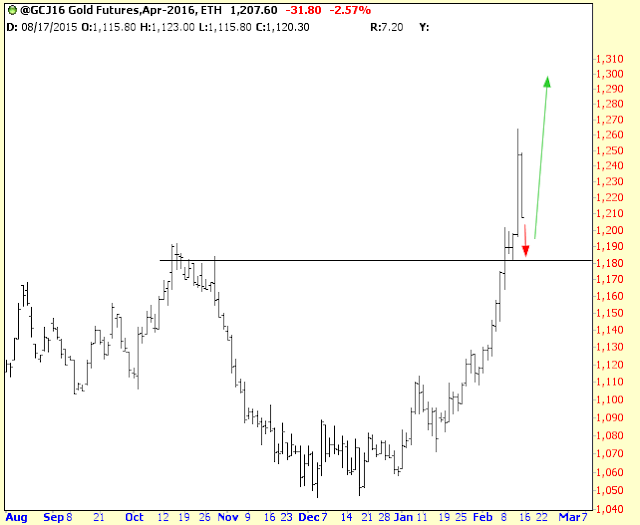

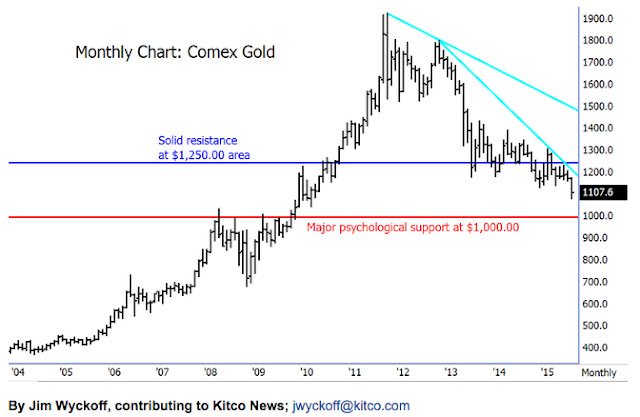

New York gold futures moved back above the $1,200 an ounce level on Wednesday on news that Greece is preparing to declare a debt default by the end of April amid stalled negotiations with its international creditors.

A report by the Financial Times On Monday said Greece will withhold $2.7 billion in May and June repayments to the International Monetary Fund because it's running out of money to pay state salaries and pensions:

A Greek default would represent an unprecedented shock to Europe’s 16-year-old monetary union only five years after Greece received a €245bn bailout

“We have come to the end of the road . . . If the Europeans won’t release bailout cash, there is no alternative [to a default],” one government official said.

A Greek default would represent an unprecedented shock to Europe’s 16-year-old monetary union only five years after Greece received the first of two EU-IMF bailouts that amounted to a combined €262bn.

Default is a prospect for which other European governments, irritated at what they see as the unprofessional negotiating tactics and confrontational rhetoric of the Greek government, have also begun to make contingency plans.

On Wednesday a report by the Wall Street Journal said negotiations between Greece and its creditors "are nowhere near resolution" for bailout money to disbursed and quotes a US Treasury official:

“It’s important that a strategy be found in which Greece can continue to honor their obligations,” the U.S. official said. “If that doesn’t happen, if there’s not an agreement on that, then there would be economic, potentially tough economic challenges, for Greece,” he warned.

“It would also enhance and amplify uncertainties for Europe and for the global economy. So it’s of great importance that an agreement be reached,” the U.S. official added.

A new report by Capital Economics which examines the relationship between the US dollar, trading at near 12-year highs against the euro, and the price of gold and argues that when the US starts to raise interest rates as it is expected to do perhaps as early as June could potentially "mean more upside for gold than the dollar:"

"The fallout from, say, a 25% rise in the gold price would be largely positive (including the boost to producers’ incomes and the favourable wealth effects). But the same rise in the dollar could have a significantly negative impact on the US economy, and prompt the Fed to delay raising interest rates. This asymmetry may be especially relevant in the event of a shock such as the break-up of the euro."

The report by Julian Jessop, Head of Commodities Research at the independent London-based research firm includes two charts showing the asymmetry of the relationship and how well gold has held up against the dollar like it did in the second half of 2008 and in the first half of 2010.

The second chart plots the gold price against Greek government bond yields as a proxy for euro-zone break-up risk. "This relationship has been more reliable than that between gold and the dollar," says Jessop, who is predicting gold will rise to $1,400 by the end of the year.

Sourced :- Frik Els of MINING.com