The following is an excerpt from monthly market overview for May 2014, written by Edward Meir, Indepent Commodity Consultant with INTL FCStone Inc.

3-MONTH LME COPPER

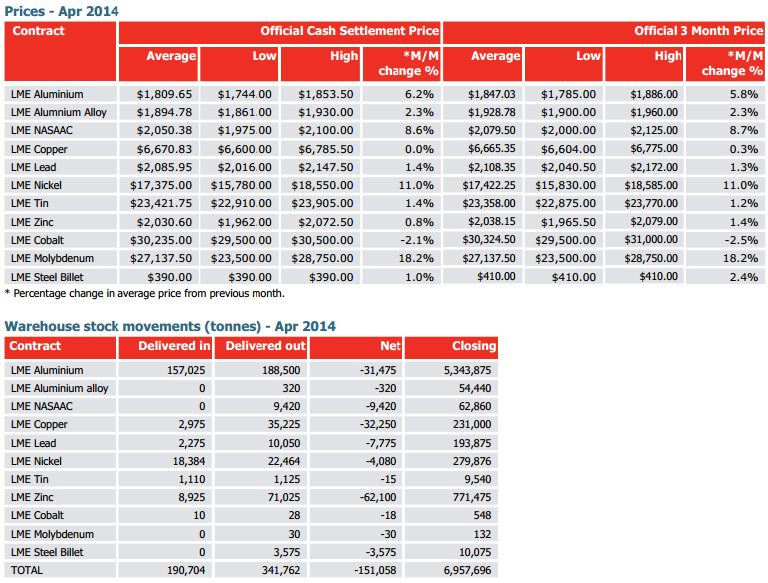

Copper traded pretty much within our forecast range of $6400-$6800for much of April, with an upward bias evident. Nevertheless, the stronger tone was not as pronounced as some of the other metals, mainly because of copper’s less-than-inspiring funda-mentals. For one thing, China’s manufacturing activity remains lackluster – the latest flash HSBC PMI for April, out last week, came in at 48.3, slightly higher than March’s 48.0 reading but still in contraction mode. This is the fourth month in a row that the number is below 50 and comes after China’s first-quarter economic growth (at 7.4%) clocked in at its slowest pace in six quarters. On the supply side, both Rio Tinto and BHP announced decent guidance for copper output this year; Rio expects to produce 830,000 tons in 2014, unchanged from 2013, while BHP is looking at 1.1 mln tons this year, rising to 1.3 mln tons in 2015. year. In addition, Mongolian copper conc volumes surged 53% year-on-year in March, as the Oyu Tolgoi project cranks up. Miners operating from Indonesia, including Freeport and Newmont, are not faring as well given the continued supply restrictions on concentrates. Chile is expected to do well, expected to produce 6.07 million tons of copper this year and 6.24 million in 2015. On the demand side, Chinese copper demand remains decent, with premiums now at their highs for the year. In addition, the government has entered the market to scoop up 2000,000 tons for its stockpile last week, but prices hardly responded, somewhat par for the course. For the month ahead, we look for a slightly higher trading range setting in, somewhere between $6500-$6900.

3-MONTH LME ALUMINIUM

Aluminum prices shot up by almost 4% in April, getting to a high of $1,900, a level last seen in October 2013. Some of this strength was due to a ruling by the UK High Court that the new warehousing rules proposed by the LME are “unfair and unlawful”. Investors interpreted this to mean that the “warehousing trade” would stay in place, keeping upward pressure on premiums and pulling flat prices higher as well. The LME said it would appeal parts of the ruling, while also announcing plans to launch a new premium contract by Q1 of 2015, a tacit admission that premium volatility is here to stay. All this augurs well for the May launch of the new CME contract, whose designers are well aware of the pitfalls surrounding the current LME contract and are keen to avoid them. In the meantime, the fundamentals of the market look uninspiring. Although some 1.3 mln tons of output have been taken off since 2013, we have yet to see the effects in the data. The latest IAI figures show global produc-tion for March (ex-China) rising again to 2.08 million tons, up from a revised 1.866 million tons in February, while March’s ex-China run-rate of 24.5 million tons was the highest since August of last year. In China, Chalco’s was the latest producer to announce a cutback (600,000 tons), but Chinese production nevertheless rose by 10.2% in the first quarter. Despite the increases, the rate of growth in both ex-Chinese and Chinese production seems to be leveling off, which is why investors have been bidding aluminum prices higher. The bullish view may end in tears unless we see more substantial cuts coming from China. We think this will eventually happen, but likely over the course of the year and going into 2015, when we are more upbeat on the market that right now. In the meantime, over the course of May, we see prices trading between $1775-$1900.

3-MONTH LME ZINC

Zinc prices posted solid gains this month, rising by almost 4% in April partly on account of improving fundamentals and on perceptions that the Chinese government is keen to avoid a slowdown, which may explain why it announced plans to speed up construction of railway lines and highways this month. Strong demand for Chinese zinc financing deals also contributed to the gains; the latest trade data shows that China took in 68,000 tons of refined zinc in March, almost double the 38,000 tons in February and a good indication that most of this metal will go into financing deals as opposed to consumption. The big in-take could also partially explain why LME zinc stocks have fallen by about 41,000 tons so far this month against a backdrop of a tightening market. In this regard, the ILZSG reports that zinc was in a 6,000-ton deficit in January to February, while for the year as a whole, the Group expects a 117,000 ton deficit. In the most recent Reuters poll, LME cash zinc was forecast to average $2060/ton this year and $2,250/ton in 2015. The mean forecasts also calls for a 50,000 ton deficit this year and a 75,000 tons shortfall next year. Shorter-term, and over the course of May, we see prices trading between $1970-$2110.

3-MONTH LME LEAD

Similar to zinc, lead prices rose by about 4% in April, reversing the downtrend seen in March. Indeed, lead enjoys the most favorable fundamentals in the LME group thanks to projections of structural deficits for both this year and next. The latest report from the ILZSG has the market in a 15,000-ton deficit in Jan-Feb, with the full-year deficit expected at 49,000 tons. Separately, a Reuters poll projects the 2014 deficit to be at 28,000 tons this year and 32,000 tons next, which begs the question as to why prices are not pushing even higher? Huw Roberts, an independent lead/zinc consultant for whom we have much respect for, told a Reuters chat forum this month that lead’s inability to rally may be due to the fact that the supply shortfall is likely overexaggerated given what he thinks is the underreported growth in secondary lead production, both inside and outside of China. In China, high secondary production (fueled in large part by concentrate imports) means that the domestic market is actually well supplied and also explains why 7,300 tons of refined lead was exported out of the country despite highs costs and no VAT rebate. Roberts sees Chinese lead growing by 7% this year, about in line with last year. Vehicle sales will drive a major part of this, but new car sales are only a small part of the market. A bigger component is batteries, especially for two and three-wheel e-bikes, which consume about 45% of all lead. Over the course of 2014, the Reuters consensus sees prices at $2180, rising to $2300 in 2015. In May we see prices fluctuating between $2040-$2180.

3-MONTH LME NICKEL

Nickel surged to a 14-month high in April, fueled by expectations that the Indonesian export ore ban will keep supplies tight for the foreseeable future, while persistent concerns over sanctions on the Russian metal sector was also a contributing factor. The latest trade numbers show China’s nickel ore imports declining sharply, with March imports off by 59% y-o-y to 2.3 million tons and well below January's 6.12 mln tons record high. Not surprisingly, ore imports from Indonesia fell 79% y-on-y and although there was an uptick of imports from the Philippines, the country will not be able to replace Indonesian volumes anytime soon. Despite the tight supply picture, we have not been seeing big drops in LME stocks; although inventories have been declining of late, they are actually higher now than where they were when the ban went into effect. In the meantime, the latest INSG report projects there will be a surplus of 50,000 tons of nickel this year, below earlier estimates. Other analysts are also shaving their surplus numbers and many are calling for a deficit for next year. However, forecasting the 2015 balance remains uncertain at this stage, as much rides on what will happen with Indonesian export policy between now and then. We are bullish on nickel, but are not starry-eyed about its long-term prospects. Remember that the Indonesian Parliament could modify the ban and the president could override part of it unilaterally (as he is legally entitled to do), in which case we could see a rather substantial selloff setting in. In addition, runaway prices could lead to demand instruction, substitution, or allow other extraction technologies to become more competitive. At the end of the day, the run-up is due to what remains an artificially-induced squeeze. As such, it could collapse equally as fast, as many of these schemes ultimately do. The latest Reuters poll shows nickel averaging $15,650/ton this year and $17,396/ton in 2015, both fairly low given the $30,000–$40,000 projections bandied about of late. We see prices trading between $17,800–$19,200 over the course of May.

3-MONTH LME TIN

Tin posted a good gain in April (up almost 4%), with much of the advance due to the inconsistency seen with regard to Indonesian tin exports. In this regard, exports have ranged from a low of 4,600 tons in December to a high of 13,560 tons in February, with the latest March number coming in at 7,800 tons. Cumulative exports since September (about the time when the new trading policies kicked in) are trending lower, clocking in at 40,000 tons, 20,000 tons below the same periods in 2011 and 2012. In response to the decline in longer-term exports, cancelled LME tin warrants have surged and now account for more than half of the tin stocks-- already low to begin with. Despite all this, investors are resisting the temptation to bid tin prices substantially higher like they did in nickel, as unlike nickel, tin units are at least flowing out of Indonesia. Moreover, more traders are using the local exchanges; ICDX volumes in March, for example, came in at 2,665 tons, but April turnover in the first week alone was 2,000 tons. In addition, first-quarter volumes totaled 10,540 tons, close to the 11,500 tons of metal exported. Another reason why tin prices have not exploded is that demand pressures are easing. China has been a consistent importer in recent years, but imports dropped sharply last year to 14,300 tons, less than half the 31,300 tons imported in 2012. That trend is continuing this year; only 2,019 tons came in during Q1 and there is now talk that China could become a net exporter for the first time since 2007. In terms of the supply/demand outlook, ITRI projects the 2014 deficit to be around 10,700 tons this year, forcing the ending stock ratio down to 2.5 weeks, the lowest in the LME space. For 2015, we see a 5,000 ton deficit forming. Over the course of May, we see prices trading between $22,600-$23,850, in line with the steadier tone we see for much of the year.

According to Goldman Sachs, nearly 61% of Chinese copper demand comes from housing and property sector. Out of which 49% accounts for housing needs including local power infrastructure, telecommunications and lighting. The balance 12% copper demand comes from installation of home appliances after property sales. It also noted that the power grid infrastructure projects accounts for only 13% of the country’s total copper demand.

According to Goldman Sachs, nearly 61% of Chinese copper demand comes from housing and property sector. Out of which 49% accounts for housing needs including local power infrastructure, telecommunications and lighting. The balance 12% copper demand comes from installation of home appliances after property sales. It also noted that the power grid infrastructure projects accounts for only 13% of the country’s total copper demand.