Gold on Thursday plunged more than $30 an ounce as eurozone troubles fade from headlines and the focus shifts to US fundamentals, the rampant dollar and a likely June rise in interest rates.

Gold on Thursday plunged more than $30 an ounce as eurozone troubles fade from headlines and the focus shifts to US fundamentals, the rampant dollar and a likely June rise in interest rates.

In heavy trade of more than 22m ounces by lunchtime in New York, gold for delivery in April fell over $35 an ounce or 2.8% from Wednesday's close hitting a low of $1,251.84 an ounce – the lowest in two weeks and the worst trading day in more than a year.

The metal is still trading up nearly $70 or almost 5.5% in 2015, but is down sharply from an intra-day high of $1,307 hit last week.

Gold's gains this year have been ascribed to safe haven buying amid currency turmoil, a slowing global economy, the continuing fallout of the collapse in oil prices and a crisis in the Eurozone.

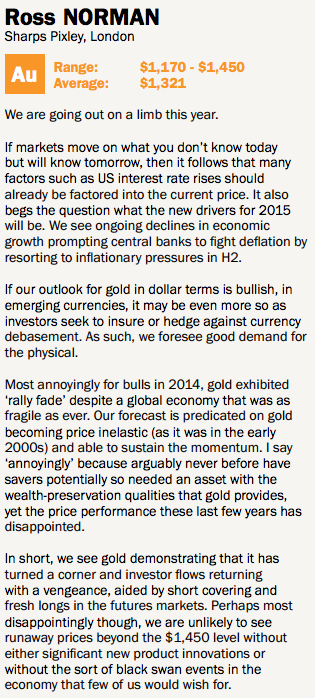

But with the first hike in more than six year likely at the Fed's June meeting raising the opportunity costs of holding gold because the metal provides no yield, gold traders refocused their attention on fundamental factors.Norman has been the most accurate forecaster – the outright winner five times and a runner up four times

The consensus forecast seem to be that today's decline was only the beginning and the gold price will trend weaker in 2015 – the third year in a row.

According to a new survey by the London Bullion Market Association of 35 analysts, gold will trade in a narrow band this year to average $1,211 a troy ounce with a range between $1,085 to $1,356 during the year.

According to a new survey by the London Bullion Market Association of 35 analysts, gold will trade in a narrow band this year to average $1,211 a troy ounce with a range between $1,085 to $1,356 during the year.

Ross Norman of Sharps Pixley is the most bullish analyst with a forecast of $1,321 average and a $1,450 high. Norman has been the most accurate forecaster in recent years coming in as the outright winner five times and a runner up four times.

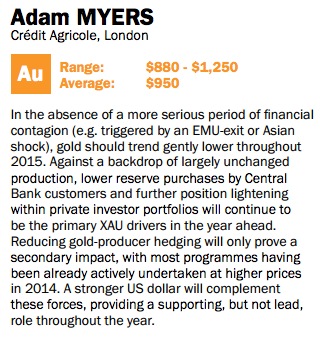

Adam Myers of Credit Agricole is the most bearish with $950 as an average and a low point of $880. Myers is one of five analysts predicting a dip below $1,000 this year.

Last year analysts were bearish on gold, forecasting a price of $1,219, according to the LBMA. The gold price averaged $1,267 in 2014, some 4% higher than estimated.

Silver, the worst performing of the four metals in 2014, is forecast to increase in price by 2.1%.

Forecasters are more bullish about the prospects of the PGM prices, with platinum predicted to be the best performing with an increase of 5.6% and palladium forecast to increase by 5.3%.

Click here for the full report from the LBMA.

Sourced from Mining.com

No comments:

Post a Comment