* Chinese private investment funds build up big short positions - sources

* Perfect storm created for selling last Friday - analyst

* No big unwinding of Chinese copper financing deals seen - traders

hinese funds taking massive short positions played a powerful role in copper's slide to around four-year lows this week, signalling the growing force of the sector in global commodities markets.

The funds had been building up bets against copper since December, according to sources at funds, futures dealers and analysts, in a market already edgy over slowing Chinese demand and fears that credit upheaval in the world's second-biggest economy could unwind financing deals using the metal as collateral.

On Friday, funds and other speculators pounced and sold London Metal Exchange and Shanghai copper contracts heavily as they took advantage of worries over the Chinese credit market after a bond default by a solar equipment producer.

The scale of the sell off shows that Chinese funds are gaining greater sway over global commodity markets -- influence that is likely to grow given China's intention to liberalise the yuan and pilot projects for free trade zones.

China has about 700 private funds managing about 300 billion yuan ($48.82 billion), according to data provided by fund research firm Z-Ben Advisors. Some invest in both commodities futures and equities markets.

Secretive and backed by wealthy individuals, many do not have an online presence.

The funds focused purely on commodities are clustered around Shanghai and nearby provinces. According to brokerage sources, hedge funds active in China’s copper futures market include Zhejiang Dunhe Investment Co, Flowinvest China Commodities Trading, Yihui Investment and the aptly named Shanghai Chaos Investment Co.

"Many hedge funds have been bearish on the copper market for a while and have been waiting for the right time to enter," said Lian Zheng, a senior analyst from Xinhu Futures Ltd in China.

Soft Chinese economic data, weak demand, soaring copper stocks and a lack of new policies to spark demand at parliament's annual meeting this week darkened the mood, while the default of Chaori Solar triggered the "perfect storm”, he added.

London copper has lost nearly 10 percent in a week and hit a 44-month low at $6,376.25 per tonne on Wednesday, before recovering a touch to $6,443. Shanghai copper traded at 44,410 yuan ($7,200) a tonne on Thursday, not far from 4-1/2 year lows.

"Prices could fall further because there are still many investors wanting to short the market,” said Lian of Xinhu Futures.

SHORT POSITIONS

Suggestions that the selling was driven by bets of falling prices can be seen in Shanghai Futures Exchange data that shows as prices slumped by 11 percent from March 7 to 4-1/2 year lows, open interest, or new positions surged by 30 percent.

"We certainly hold short positions...at least for the first half of the year," said a source at a Chinese fund, who declined to be named because he was not authorised to talk to the media.

The fund held short positions on the LME and in Shanghai but the source said it would consider changing these if demand improved or copper prices were near the production costs of large global miners.

Chinese copper miners have also lifted hedging in Shanghai for their ore production to protect against possible price drops, increasing short positions, two mining sources said.

China is the world's top consumer of refined copper, accounting for about 40 percent of demand, but growth has slowed since last year and a global surplus of the metal is expected in 2014.

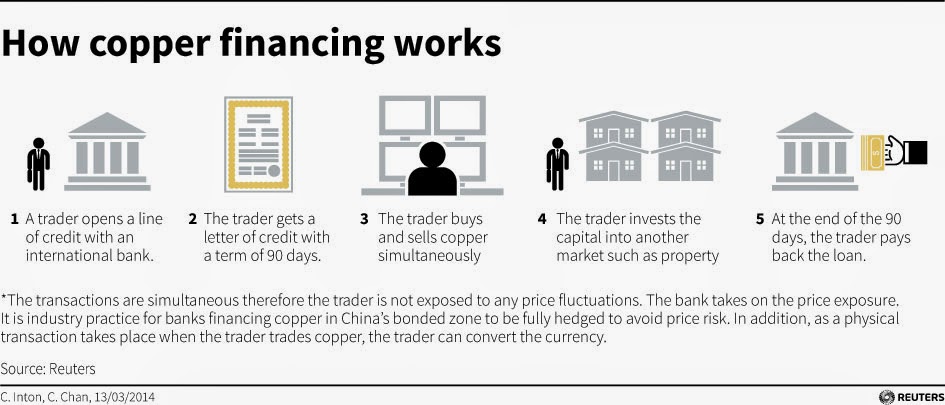

Traders estimate more than half of copper imports into China were to raise funds using the metal as collateral over the past two years, hence the market concern over the impact of Beijing's efforts to control credit conditions and rein in shadow banking.

But tighter credit markets or falling prices were unlikely to cause widespread problems in financing deals because they were structured around 90-180 day letters of credit, which means they are not affected by short-term price moves, said Sijin Cheng, an analyst with Barclays in Singapore.

"It's not like it's a margin call business and they're being forced to liquidate. It's usually a repurchasing agreement where both sides are hedged, so all the costs are known ahead of time and locked in," said Cheng.

Traders who structure financing deals said selling of copper was due to speculators not breaches of financing deals.

"Speculators are the main driver. We haven’t heard anything about defaults," said a source at a trading house in Shanghai.

No comments:

Post a Comment